Cme Heating Oil Options

The company is comprised of four designated contract markets dcms.

Cme heating oil options. Trade heating oil globex now with. All futures news complete futures news search news. Options are also a derivative instrument that employ leverage to invest in commodities. Global continuous manufacturing market 2020 2030.

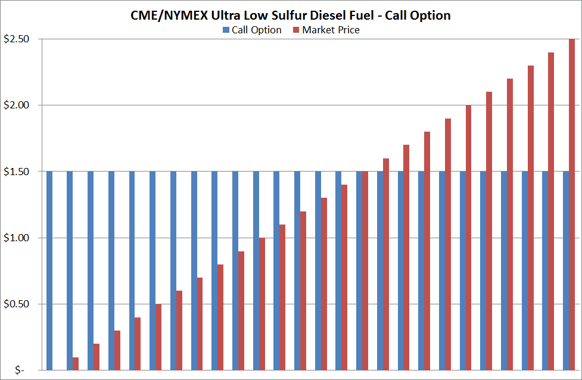

Cme group s new york harbor ultra low sulfur diesel ulsd contract hit the big 4 0 on november 14 2018. The company offers futures and options on futures trading through the cme globex. The nymex offers an options contract on heating oil futures. The long awaited switch to ultra low sulfur heating oil on the cme owner of the new york mercantile exchange nymex has arrived.

Further information on each exchange s rules and product listings can be found by clicking on the links to cme cbot nymex and comex. The spread created in commodity markets by purchasing oil options and offsetting the position by selling gasoline and heating oil options. Geopolitical concerns in the middle east can cause extreme volatility in the crude oil futures and options markets as well as the distillates such as unleaded gasoline and heating oil. Current market landscape and future opportunities sep 9th 2020 05 28 pmz length.

Cme group inc said its markets are working properly after crude oil futures sank into negative territory for the first time ever on monday. Access more than 100 fuel oil futures and options contracts covering the global fuel oil market available on clearport and cme globex. Here is the brochure from the cme group nymex for wti crude oil futures and options. Wti crude oil brochure.

As with futures options have an expiration date. Cme group is the world s leading and most diverse derivatives marketplace. 35 years after inception the world s oldest energy futures contract has been given a facelift. Niche and innovative products such as minis and dailies to complement our clients changing hedging and clearing needs.

This investment alignment allows the investor to hedge against risk due to the offsetting nature of the securities. A key cog in energy markets turns 40.