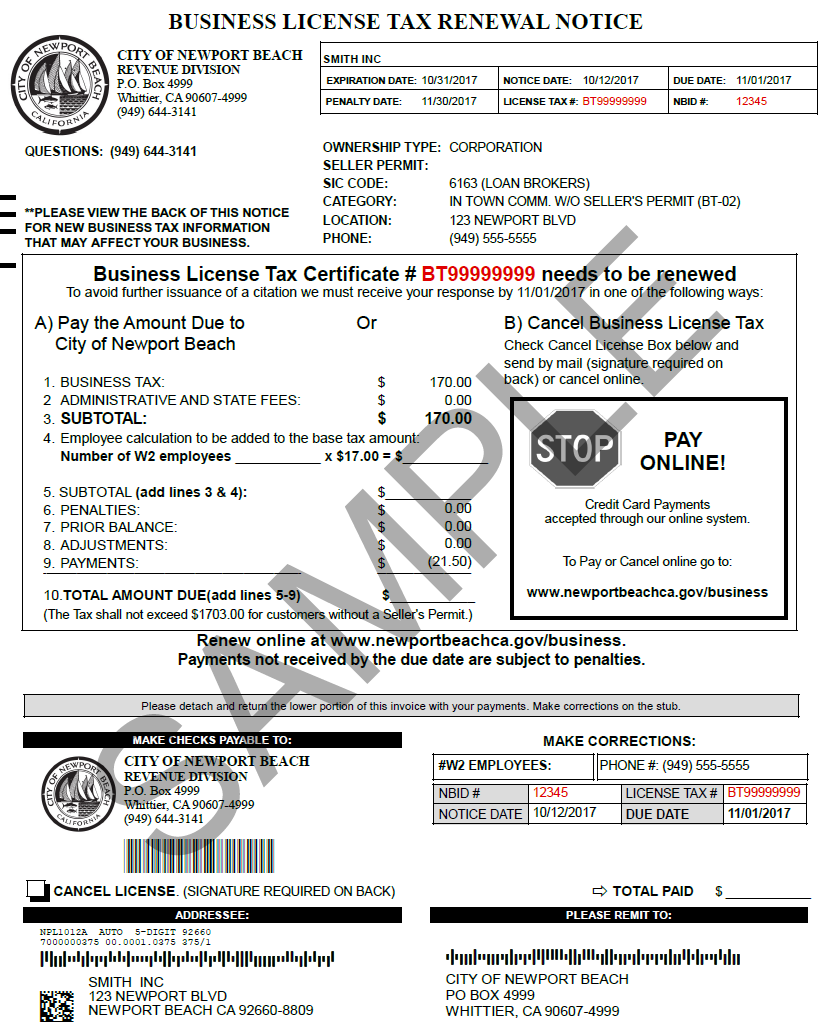

City Of Newport Beach Business License Tax

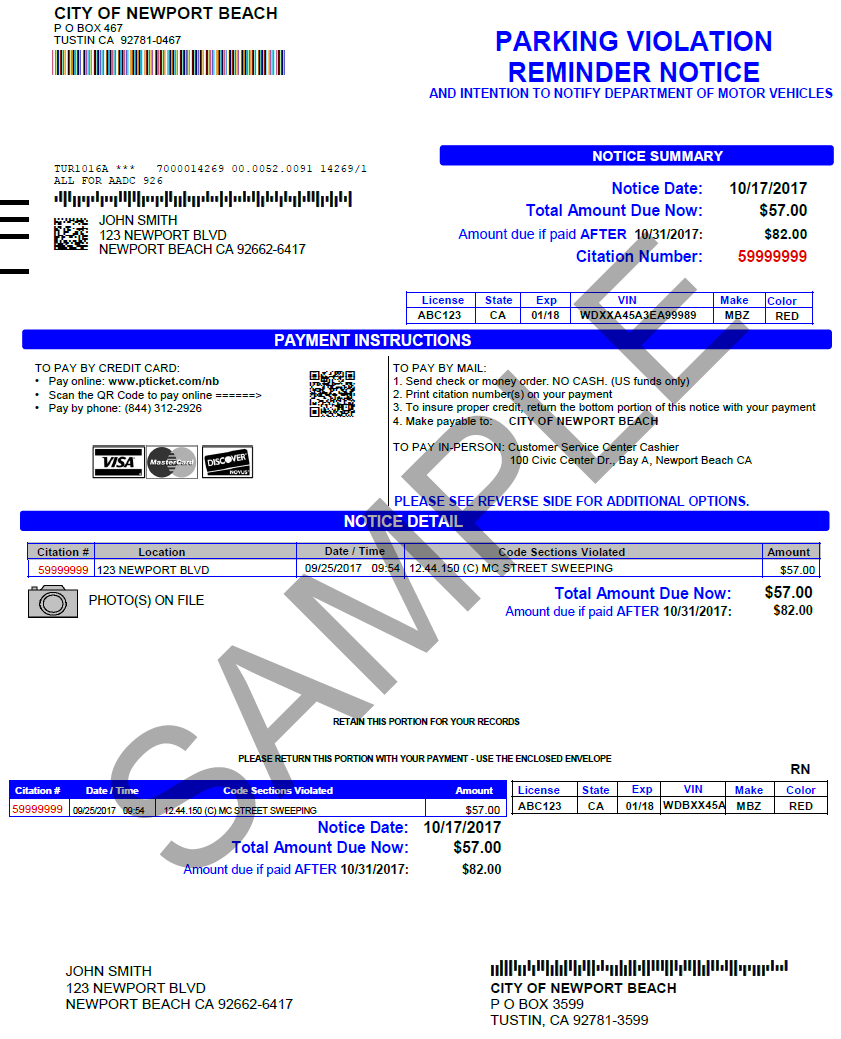

Fire hazards violations.

City of newport beach business license tax. Click the link to your city below to apply for a business license. Starting or expanding my business. Search for a business. Please select a.

Bidding contract opportunities. Small business relief grants. Newport news business license tax. Report an unlicensed business.

Most bpol taxes are based on the gross receipts earned by a business in the previous year. The city of newport beach city municipal code provides that every business operating in the city is required to file a business license tax application prior to the start of business and pay the annual tax each year thereafter. City of newport beach. If you need more information you can contact the city of newport beach revenue division at 949 644 3141.

You have an active business if you have not properly closed your business by either closing with the assessor s office in person or by filling out the close of business form by mail. Civic center directory and map. This ordinance applies to businesses operating at a commercial or residential location within the city or any business using an address in newport beach or a post. 58 1 3700 of the code of virginia determines which business activities are required to obtain a business license also known as a business professional and occupational license bpol tax.

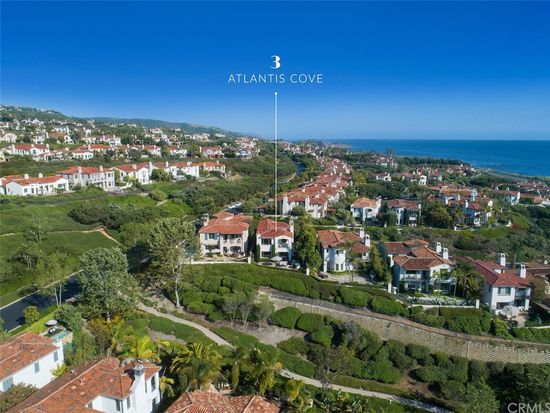

2019 tax bills are for active businesses during the 2018 calendar year. The office is located at 100 civic center drive in newport beach. My requests new request. The city of newport beach website contains a wealth of information for those starting a new business.